5 Ways Public Liability Insurance Can Save Your Business

Operating a business comes with many risks and responsibilities. One of the most important things you can do to protect your business is to have adequate public liability insurance. Public Liability Insurance (PLI) works as a protective measure against accidents and liabilities. It covers your business for claims made by the general public against that business. People who suffer injury or property damage as a result of your business activities can potentially file a public liability claim. Additionally, this insurance covers reasonable legal fees or expenses that you may incur when contesting claims lodged against you.

In addition to covering incidents involving personal injury, public liability policies could extend to cover product liability too. If you have a business where you sell, supply or deliver goods, you may require negligence claim covers. This policy will protect you against claims where your product has caused injury or other damage to clients. Any business that interacts with the public, whether directly or indirectly, can benefit from PLI. This includes sole traders, subcontractors, small business owners, and larger corporations. Regardless of the size or nature of your business, having PLI in place provides essential protection against unforeseen liabilities.

What Does Public Liability Insurance Cover?

Public liability Insurance (PLI) protects small businesses against claims from injured customers or clients. It covers the costs associated with accidents or injuries that occur on business premises or are caused by business products or services. This insurance for public liability covers the following aspects in general-

- Bodily Injury: This includes medical expenses, lost wages, and other compensation for injuries sustained by the customer. The insurance also covers the first aid expenses at the time of an incident.

- Property Damage: It covers repair and replacement costs for property damage by your business activities. For example, if a customer slips and falls and breaks a piece of merchandise in your shop, the insurance covers the loss or damage as well.

- Legal Defence: Public liability insurance covers legal fees associated with defending yourself in court.

- Staff Negligence: Claims may arise from injuries or damage caused by the negligent actions of employees during their work. This includes situations where staff neglect to take reasonable care, like not cleaning up spills or neglecting to use warning signs.

5 Ways Public Liability Insurance Protects Your Business

Insurance for a company or small business works as a financial safety net against claims and liabilities. Having PLI is vital to safeguard your business. This cover helps shield you from the hefty expenses of compensation, legal fees, and harm to your reputation. Here are 5 key how public liability insurance protects your business:

- Protects Against Costly Lawsuits: Any accidents, minor slips, or falls on your premises can lead to expensive legal fees and compensation payouts. Public liability insurance shields your business from the financial burden of such lawsuits.

- Minimises Financial Losses: Without insurance coverage, you would have to personally pay for these costs. These added expenses can derail your business’s growth or early closure. PLI covers such payouts up to your policy limit.

- Enhanced Credibility and Trust: The public liability insurance cover gives your business credibility and trust. It shows that you are responsible organisation and reliable. This will enhance your reputation, leading to repeat business and new opportunities.

- Peace of Mind and Confidence: A comprehensive liability insurance lets you focus on running your business. You can make better decisions without worrying about legal complications and pursue growth opportunities with confidence.

- Covers Legal Costs: This insurance sometimes covers legal costs associated with property damage caused by your business activities. It gives you an additional layer of protection against injuries caused by your business activities or negligence. Having the proper coverage ensures you remain compliant and avoid potential fines or penalties.

4 Tips for Choosing the Right Public Liability Insurance for Your Business

The business indemnity insurance covers you against accidents and liabilities. However, not all the policies are created equal. Choosing the right cover that suits your specific business needs is important for your business growth. Here are the 4 key tips when looking for the ideal public liability insurance for your company:

- Ensure The Policy Covers All Of Your Business Activities: The public liability policies cater to suit different types of businesses. However, before purchasing a policy, cross-verify whether it adequately supports your business activities.

- Understand Your Coverage Needs: Settle your accident coverages based on your risk assessment. Consider the ways your business activities, products, or services could potentially harm members of the public. High-risk industries like construction need higher limits.

- Get Multiple Quotes: Get quotes from multiple reputable insurers and compare coverage details, terms, pricing, etc. You should always read the fine print to understand what the insurance policy covers and does not cover.

- Check the State/Territory Requirements: Familiarise yourself with the local laws regarding liability insurance to ensure compliance. Most businesses participating in industry associations and professional memberships require a minimum level of coverage.

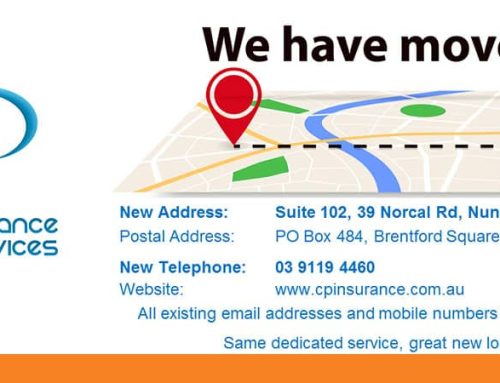

Why Choose CP Insurance Services?

Public claims against your business can be costly and impact your reputation. That’s where professional insurance services step in. CP Insurance Services is a Melbourne-based agency, offering some of the best company insurance products for your business. We collaborate with top insurance providers in Australia to offer you the best coverage and competitive quotes. When you partner with us, you get –

- Expertise in the Insurance Industry: Our team consists of experienced professionals with extensive knowledge of business risks and needs. Partnering with top Australian authorised insurers, we provide reliable protection for your business.

- Personalised Protection: We offer personalised insurance policies at the most competitive rates at each renewal. Our tailored insurance and risk management solutions provide structured coverage to mitigate risks effectively.

- Excellent Customer Service: Our team is responsive towards your queries and prioritises open communication. We offer expert guidance and honest advice on insurance policies for individuals and businesses.

- Quick Turnaround Time: We provide claims assistance to facilitate quick processing. We assist you with lodging claims and liaising with insurers to ensure a smooth and hassle-free process.

For competitive alternatives for all your commercial and personal insurance needs, contact CP Insurance Services. Call us on 1300 884 698 or email us at webenquiry@cpinsurance.com.au for further information or to discuss your specific business requirements.

Leave A Comment