Determining the correct sum insured for many businesses can be a very difficult task.

The general recommendation is the following two considerations toward determining the replacement costs for contents and stock.

Contents: The cost to replace all fixtures and fittings, including office equipment within the business location.

Stock: The total cost to yourself to replace all your stock holding within your store, including also, stock stored on the premises.

In other words:-

If you needed to replace everything in your business right now, how much would it cost?

There are several additional guides available to assist in determining both of the above.

Contents:

The best source, to help determine the correct replacement value of all contents, for any business, can be found within the Business’ set of financial documents.

One such document named Balance Sheet, will have several items listed under the heading Non-Current Assets. Your Accountant will most likely have the most recent version of this document.

Within this section, there will several items listed:

- Plant & Machinery

- Fixtures & Fittings

- Computers

- Furniture

- Other

The total figure, across of these headings should represent the total value of all contents of the business.

It is this figure that is to be used as the Contents Sum Insured within your Business Insurance Policy.

Stock

Depending upon the type of your business, your business may operate using Point of Sale (POS) software.

Within this software will be several stock reports, of which a report named Stock Inventory Report, will list all items that the business currently has for sale.

With all Insurance claims, when replacing lost stock Insurers will only pay the wholesale cost of the items.

Or in other words, what it costs you to obtain the stock item, not what you are selling it for.

Therefore, the Stock Inventory Report will have a total wholesale value (or cost value) within the report.

It is this figure that should be used in setting the Stock Sum Insured within your Business Insurance Policy.

Self-Insurance

In some cases, a business may choose to elect to Self-Insure a percentage of the total Contents and Stock of the business.

For example: A Business with the following figures.

Contents $100,000: Stock $500,000: Total $600,000

May choose to determine that only 70% of the total, needs to be insured, 30% the business will replace at their own cost.

This determination however, can lead toward creating a level of under insurance, which could result in penalties within an Insurers claim payment.

Any business considering determining any self-insurance limit should seek advice and recommendation from an accredited Insurance Broker.

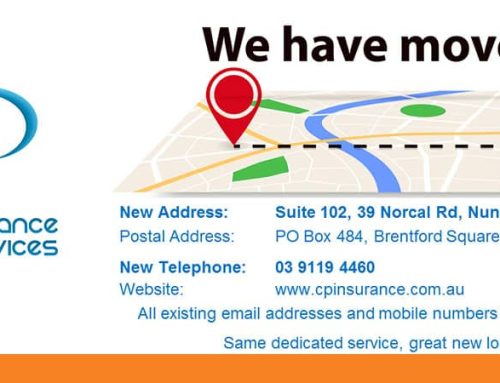

For further information or to discuss your specific business requirements, contact CP Insurance Services on 1300 884 698