One of the most crucial aspects for any business, is the income that is generated by the business activities. Without income, businesses cannot pay wages, rent, mortgages, advertising and all other expenses.

With that in mind, businesses need to ask, what would happen if my business was unable to operate? Especially if an insured event occurs, such as a fire, storm damage or even burglary?

If a business could not operate, then for how long could the business continue paying expenses, without any income generated? 1 – 2 months?

What if however, that duration was extended to 6, 12 or even 18 months?

In most cases, such extended durations would result in permanent or extended closure of the business. Leading to a very sad end to any operation, especially those that have operated for several years and have large levels of loyal customers.

To prevent this from occurring, business insurance policies include a section named Business Interruption, which in other words can be considered as income protection for a business.

Yet despite being available within most business insurance policies, less than 40% of small and medium enterprises have Business Interruption Insurance.

Whilst every Business Owner and Manager is cost-conscious, the saving in premium through not taking the Business Interruption coverage option, pales into insignificance when compared to the costs of a business closure. Especially when considering the flow on effects such as failure to maintain Mortgage and Loan repayments.

So, what does Business Interruption Cover?

In short, the total amount necessary for a business to pay all fixed expenses such as:

- Wages,

- Mortgages,

- Utilities (Electricity, Gas etc),

- Rent,

- Advertising

- and others.

This amount being the Insurable Gross Profit. Which can be calculated via many different methods.

The simplest (and often most accurate) equation being:

Total Annual Turnover,

Less Total Costs of Goods sold = Insurable Gross Profit.

For example, a florist store could have a calculation such as:

| Total Turnover | $300,000 |

| Costs of goods sold | – $135,000 |

| Insurable Gross Profit | $165,000 |

Business Interruption cover, can also be extended to include coverage for other expenses that a business may encounter, such as:

- Temporary rent for alternative premises,

- Additional advertising,

- Additional wages or staff,

- Additional costs to recover monies owed to the business,

- Costs to prepare and submit a claim,

- And others.

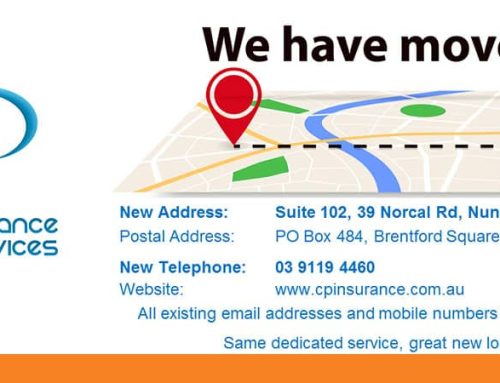

For further information or to discuss your specific business requirements, contact CP Insurance Services on 1300 884 698.